Hiring finance and legal talent has never been harder, or slower. U.S. companies are competing for a reserved pool of candidates, and every delay affects payroll, reporting, and compliance.

That’s why more B2B SaaS teams are hiring nearshore.

Working with professionals in Latin America, help companies get timezone-aligned talent without overspending or cutting corners. These are specialists trained in U.S. systems, fluent in English, and ready to step into accounting, payroll, legal ops, and reporting roles.

But not every staffing partner works the same way.

Some push resumes. Others manage the hiring process end-to-end, with clear timelines, role-matching, and post-placement support.

This guide emphasizes the nearshoring agencies built to help U.S. finance and legal teams. You’ll see who focuses on specific functions, where they operate, and which ones are worth shortlisting.

While this guide focuses on finance and legal teams, the best Latin American countries to hire sales talent frequently coincide with those offering strong financial professionals.

Key Takeaways:

-

U.S. companies are hiring nearshore finance and legal professionals in Latin America to reduce hiring delays, maintain U.S. working-hour overlap, and support payroll, reporting, and compliance without the friction of offshore operations.

-

Nearshore staffing agencies place bilingual professionals trained in U.S. finance and legal systems into roles such as accounting, payroll, tax support, contract analysis, and compliance operations.

-

Latin American markets, including Mexico, Colombia, Argentina, and Brazil, supply finance and legal talent with strong English fluency, familiarity with U.S. standards, and experience supporting SaaS and regulated businesses.

-

Nearshore staffing firms differ in execution, with higher-performing partners managing sourcing, vetting, onboarding, payroll, and compliance, rather than simply forwarding resumes.

-

Agencies featured serve finance and legal hiring needs through staff augmentation and full-time placement, helping companies scale back-office teams with real-time collaboration and predictable costs.

-

Nearshore finance and legal hiring improves operational continuity by shortening hiring cycles, lowering labor costs, and keeping sensitive workflows aligned with U.S. schedules.

What is Nearshore Hiring?

Nearshore hiring is when U.S. companies build remote teams in nearby regions, typically Latin America, without adding timezone delays or bloated payroll.

Finance and legal teams usually need tight turnaround times and close coordination. That’s difficult when contractors are based 10 hours away. Nearshore staffing solves that problem with real-time communication and better overlap.

Companies hire nearshore professionals for roles like payroll analysts, paralegals, bookkeepers, and compliance support.

The talent pool is deep, bilingual, and familiar with U.S. reporting standards.

The nearshore model is about reducing friction. You get qualified candidates from regions that already work with U.S.-based clients and understand your expectations.

Many businesses use nearshore staffing services to avoid long hiring cycles or increased local salaries. Others are replacing offshore outsourcing with nearshore solutions to recover visibility and keep projects moving.

Mexico, Colombia, and Argentina have become top nearshore markets. Startups are also turning to Brazil to hire developers and finance talent, thanks to its strong workforce and deep U.S. business exposure.

These countries offer finance and legal professionals who work U.S. hours and deliver results without the chaos of timezone mismatches or communication barriers.

What Are Nearshore Staffing Companies?

Nearshore staffing companies connect U.S. teams with remote professionals based in nearby countries, most often in Latin America. These businesses help B2B SaaS startups and enterprises hire nearshore without wasting time on sourcing, vetting, or compliance.

Instead of running a drawn-out recruitment process, companies partner with nearshore firms to find specialized talent that works the same hours, uses familiar tools, and speaks fluent English.

For finance and legal teams, these providers are not just resume distributors. They deliver nearshore staffing solutions tailored to your tools, workflows, and industry expectations.

Roles commonly filled through nearshore staffing companies include:

- Payroll specialists and tax accountants

- Billing analysts and SAP finance specialists

- Staff accountants and controllers

- Compliance officers and regulatory reporting analysts

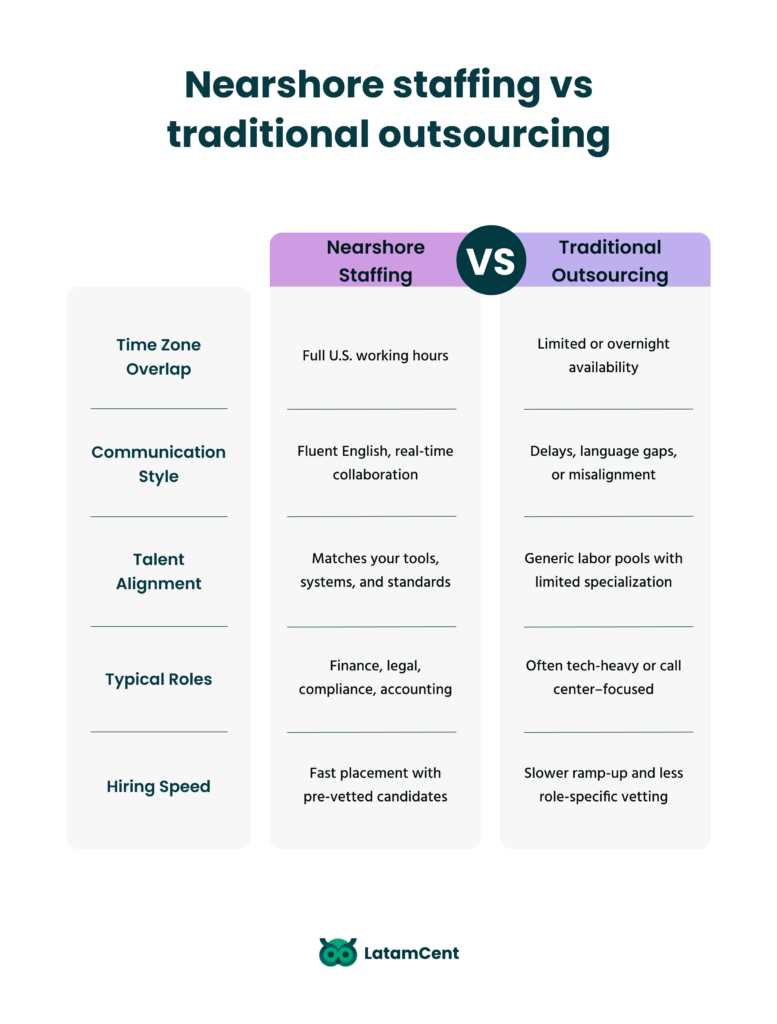

Far from traditional outsourcing companies that focus on offshore outsourcing alone, nearshore firms understand the value of time zone compatibility, clear communication, and cultural compatibility.

Hiring managers looking to reduce operational costs without lowering standards choose nearshore staffing to:

- Access vetted talent in top nearshore markets

- Improve coordination through real time collaboration

- Reduce reliance on expensive onshore outsourcing

- Build long-term teams for finance and accounting

Each partner varies in quality. The right nearshore outsourcing partner will focus on business needs first, then match you with high quality talent that fits your scope, budget, and back office operations.

Why Are B2B SaaS Companies Hiring Nearshore Finance & Legal Teams?

B2B SaaS companies move fast, and their finance and legal operations need to keep up. That’s why more are turning to nearshore hiring across neighboring or nearby countries.

Nearshore staffing gives teams access to skilled professionals without timezone delays or inflated local salaries. Instead of competing in crowded U.S. markets, companies tap into remote talent in Latin America with the same systems, tools, and business logic already in place.

Many finance leaders use nearshore staffing solutions to build lean, high-performing teams.

Here’s why SaaS leaders are shifting from onshore and offshore outsourcing to nearshore teams:

- More cost efficiency than U.S.-based hires

- Better coordination than offshore outsourcing

- Shorter hiring cycles through specialized staffing services

- Access to a larger talent pool with relevant experience

- Familiarity with finance and accounting frameworks used by U.S. SaaS companies

- Real-time updates from professionals who work the same hours

Roles like payroll lead, tax analyst, and contract paralegal no longer require someone in your city. Teams now hire nearshore talent to keep back office operations lean and responsive.

Most importantly, nearshore outsourcing services give companies room to scale, without stretching headcount or risking data security. Many agencies help companies determine whether they need a freelancer, contractor, or full-time hire based on team size, workload, and risk profile.

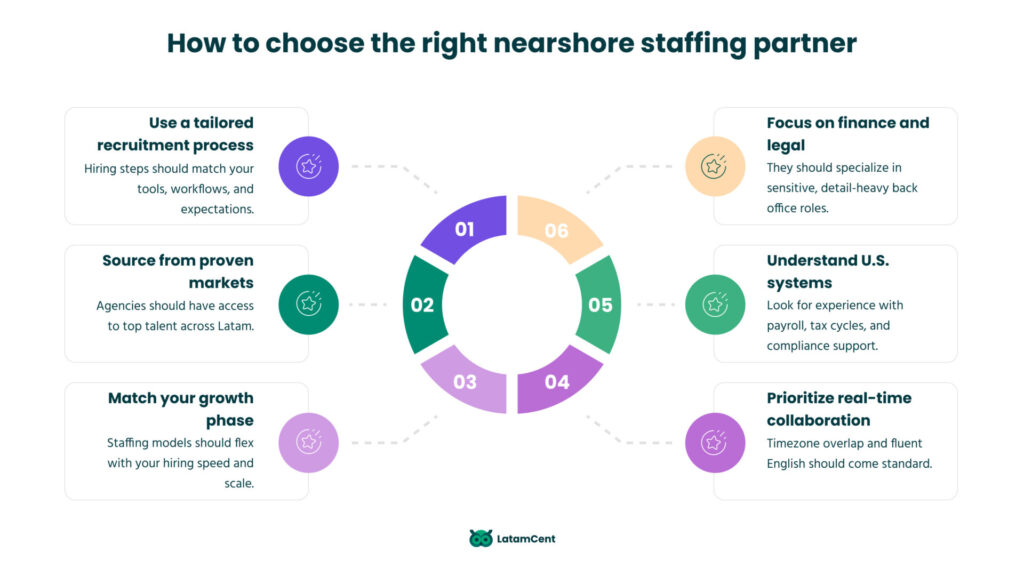

What to Look for in a Nearshore Staffing Agency for Finance & Legal Roles

Hiring for finance and legal is about finding nearshore talent that protects data, meets deadlines, and knows what’s at stake when numbers or filings go wrong.

The right nearshore agency won’t just send options. It will guide your hiring team, vet candidates thoroughly, and understand how financial and legal roles support business operations.

For B2B SaaS companies, nearshore staffing should bring more than cost savings. It should reduce hiring risk and raise the quality of execution across finance and accounting services.

Here’s what to prioritize when evaluating nearshore staffing companies:

- Experience with finance professionals and legal support hires

- Clear understanding of payroll systems, tax law basics, and U.S. reporting cycles

- Fluent English and timezone compatibility for real-time updates

- A recruitment process tailored to back office roles

- Presence in popular nearshore outsourcing destinations with proven talent pools

- Flexible staff augmentation services that match your current phase of growth, an important distinction when comparing staff augmentation vs outsourcing for finance teams.

Companies seeking to hire nearshore talent for sensitive roles also look for cultural alignment, process transparency, and accountability after the handoff.

Avoid firms that treat finance and legal like an add-on to more general business process outsourcing. The best partners focus on placing skilled professionals.

Look for a nearshore outsourcing partner with a proven track record, strong references, and specialization in remote team solutions for finance and legal functions.

Some of the agencies listed here also operate as software development nearshoring companies, offering full-stack engineering alongside finance support.

12 Best Nearshore Staffing Agencies for Finance & Legal Hiring

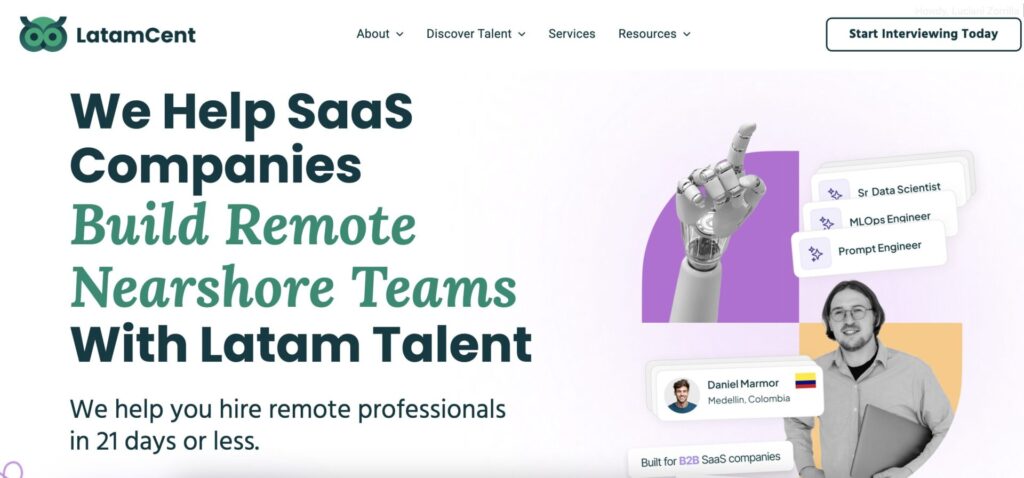

1. LatamCent

LatamCent is a Miami-based company that connects B2B SaaS startups and growth-stage teams with vetted nearshore professionals fluent in English and U.S. business practices. The agency focuses on high-stakes roles like chief accounting officers, budget analysts, and risk analysts, delivering nearshore remote talent that fits into existing tools and workflows.

Clients benefit from roles filled in under 21 days, along with a 100-day guarantee that reduces hiring risk. The service includes flat-rate payroll, legal compliance, and direct Slack or ATS integration, reducing friction in the onboarding process.

For companies seeking cultural alignment and time zone compatibility, LatamCent helps fill back office functions without slowing business operations. Its network includes top tier talent in Latin America across accounting services, contract staffing, and finance operations.

Ideal for SaaS leaders who want specialized skills, faster ramp-up, and a nearshore outsourcing model that prioritizes business growth over volume hiring.

2. Remote Team Solutions

Remote Team Solutions helps U.S. businesses hire nearshore talent across accounting, HR, and legal admin. The company supports clients with contract staffing needs and back office operations, offering cost savings through customized solutions in Latin America.

Best suited for accounting firms or outsourcing companies looking to reduce overhead using remote professionals based in popular nearshore outsourcing destinations.

3. Wow Remote Teams

Wow Remote Teams focuses on sourcing remote talent across finance support, executive assistance, and data entry. The agency builds remote team solutions using staff from Latin America, supporting nearshore hiring for small and mid-sized companies looking for accounting outsourcing or budget-friendly admin help.

Best for teams that need skilled talent without lengthy timelines or inflated fees. Ideal for U.S. companies experimenting with nearshore staffing in specific local markets.

4. OP360

OP360 is one of the larger nearshore companies offering end-to-end staff augmentation in finance, back office, and customer operations. Their team places nearshore talent across multiple countries and provides infrastructure for scale.

Best for enterprises or outsourcing companies seeking custom solutions and significant cost savings through high-volume nearshore staffing. Strong fit for firms looking to hire nearshore remote talent across multiple departments.

5. Near

Near offers nearshore outsourcing with a focus on remote professionals in Latin America. The company supports staff augmentation for accounting firms, startups, and mid-market clients, using a vetted talent pool across finance functions.

Best for teams seeking nearshore talent with U.S. accounting software experience and clear timezone compatibility. A solid option for companies needing reliable remote team solutions with customized support and onboarding.

6. Amalga Group

Amalga Group specializes in accounting outsourcing through nearshore hiring models. Its main strength is placing skilled talent in transactional roles, AP, AR, reconciliations, and financial reporting, supported by a U.S.-led leadership structure.

Best for finance leaders looking to reduce costs.

A reasonable choice for businesses seeking nearshore staffing in back office functions that require consistent delivery and direct management.

7. Solvo Global

Solvo Global helps U.S. businesses hire nearshore remote talent for finance and back office operations. Their focus is on contract staffing for roles like bookkeepers, international accountants, and collections specialists, primarily through placements in Colombia and surrounding local markets.

Best for companies seeking skilled talent with bilingual fluency, strong documentation practices, and familiarity with U.S. finance workflows.

Works well for teams pursuing significant cost savings without losing daily visibility.

8. Net2Source

Net2Source offers nearshore staffing through delivery centers in Latin America.

Its nearshore outsourcing services support back office teams through specialized services in finance, accounting, and compliance, offered via models similar to Employer of Record (EOR) providers in Latin America, oftentimes alongside more comprehensive software and IT functions.

Best for companies looking to hire nearshore professionals across multiple departments and regions. Suited for enterprises needing a partner with both staff augmentation scale and business process flexibility.

9. The Strategic CFO

The Strategic CFO offers nearshore staffing through its Colombia-based finance operation. Their team focuses on placing nearshore talent in recurring roles like reconciliations, reporting, and close support. The agency blends nearshore hiring with direct CFO leadership to protect quality.

Best for midsize firms that need consistent accounting output and want nearshore outsourcing without losing internal control. Especially useful for finance teams looking for remote professionals familiar with GAAP and monthly close cycles.

10. TrueLogic

TrueLogic offers nearshore staffing solutions through Latin America, with a focus on building finance and administrative teams. The agency emphasizes custom solutions based on role type and experience level.

Best for companies seeking nearshore remote talent for finance support roles such as bookkeeping, expense reporting, and data audits. A good fit for teams exploring staff augmentation as a way to scale slowly.

11. CoDev

CoDev provides accounting outsourcing through nearshore and offshore staffing channels. Their finance support offering includes roles like virtual accountants, AP/AR, and accounts payable specialists. The firm supports clients through both contract staffing and direct placements.

Best for companies hiring across both accounting and software development, especially when looking to consolidate vendors under one staffing partner.

12. Vaco

Vaco offers full-cycle staffing services for finance professionals, including options to hire nearshore through delivery hubs in Latin America. Its team supports transactional and strategic finance roles with experienced recruiters who understand compliance and reporting needs.

Best for larger companies with in-house finance functions looking for top talent and a global recruiting partner that includes nearshore capabilities among broader solutions.

Roles You Can Fill With Nearshore Finance & Legal Talent

Accountants, Bookkeepers, & Billing Analysts

Nearshore staffing is ideal for hands-on finance roles that require daily execution, strong documentation, and cross-functional collaboration. B2B SaaS companies usually fill these roles to support their revenue cycle and maintain clean books.

- Project Accountant: Tracks budgets, allocations, and actuals across departments

- Revenue Accountant: Oversees billing operations and revenue recognition compliance

- Grants Accountant (Nonprofit): Manages restricted funds and reporting tied to donor guidelines

- Endowment Accountant: Tracks fund performance, restrictions, and long-term distribution plans

- Nonprofit Controller: Leads finance operations for nonprofit teams with grant-based income

These roles require attention to detail, consistent reporting cadence, and often familiarity with multi-entity or nonprofit workflows, making them strong fits for nearshore remote talent trained in U.S. frameworks.

Financial Analysts, FP&A Managers, & Controllers

Strategic roles in finance no longer need to sit in your HQ. With nearshore outsourcing, companies can build analytical teams that work in real time, without inflated salaries or timezone delays.

- Financial Analyst: Delivers modeling and forecasting at the division or portfolio level

- FP&A Analyst: Manages long-range planning, scenario models, and budget cycles

Companies hire nearshore talent for these roles to improve flexibility, maintain executive-level oversight, and expand finance teams with specialized skills, without relying on expensive onshore outsourcing or long hiring cycles.

Payroll, Tax Support, & Compliance Officers

These roles demand accuracy, discretion, and familiarity with regional tax codes and reporting frameworks. Nearshore staffing helps finance teams handle sensitive workflows.

- Insurance Analyst: Evaluates risk exposure and monitors coverage requirements

- Sarbanes-Oxley (SOX) Compliance Manager: Maintains controls and documentation required for public company standards

Nearshore professionals in these positions bring experience from accounting firms or shared service centers and are used to tight reporting timelines. B2B companies looking to hire nearshore remote talent in these areas value consistency and high-quality execution.

Risk Analysts, Legal Support, & Venture Capital Analysts

As companies grow, legal and investment workflows become more complex.

These roles support decision-making, contract enforcement, and capital efficiency. Nearshore outsourcing makes them accessible.

- Private Equity Associate: Supports deal execution, diligence, and investor reporting

- Quantitative Financial Analyst: Builds models that guide capital structure or M&A evaluations

Treasury, Capital Markets, & Financial Operations

These functions are critical in companies managing large transaction volumes, international payments, or investment portfolios. Nearshore professionals bring experience from banking, fintech, and corporate finance, delivering reliable support without overextending your team.

- Treasury Analyst: Tracks cash flow, debt obligations, and short-term liquidity positions

- Capital Markets Analyst: Supports issuance tracking, investor outreach, and market trend analysis

- Commodity Finance Specialist: Manages contracts, hedging strategies, and pricing models tied to resource-based industries

These roles require top talent with strong technical acumen and attention to detail. Nearshore staffing makes it possible to fill them fast, mainly when companies are growing and need specialized support to avoid bottlenecks.

Systems, Tools, & Regulatory Finance

Finance operations don’t run without systems.

Companies depend on professionals who understand platforms like SAP, NetSuite, and Oracle, along with those who manage compliance reporting and regulatory submissions. These hires require platform fluency and knowledge of finance workflows.

- Financial Systems Analyst: Improves tool adoption and connects finance platforms to reporting logic

- NetSuite Administrator: Maintains the platform backend and supports configuration for accounting and reporting

- Regulatory Reporting Analyst: Prepares submissions for external regulators and internal audit teams

Nearshore outsourcing services are a strong fit for these positions, for companies that need cross-system reliability and don’t have time to train new hires from scratch. Many nearshore professionals bring system certifications and prior experience from multinational teams.

Benefits of Nearshore Outsourcing Finance Roles

Falling behind on finance deliverables creates pressure across the business.

Teams start missing filing deadlines, investor reports get delayed, and month-end closes drag on longer than they should. These differences usually come down to bandwidth, not competence.

Nearshore staffing helps companies expand coverage with finance professionals already trained on U.S. reporting cycles and tools. Teams gain extra capacity without bloated hiring timelines or inflated budgets. Roles are filled faster, workflows stay intact, and internal teams keep momentum through busy cycles.

This hiring model fits well for both recurring and temporary needs, particularly when headcount freezes or expansion plans stall.

Nearshore professionals commonly support:

- Monthly reconciliations and financial reporting

- Payroll and expense administration

- Tax calendar preparation and coordination

- Interim coverage during transitions or parental leave

- Data handoffs for audits, board prep, or M&A due diligence

Finance leads gain flexibility, but also consistency.

These professionals work in real time, communicate clearly, and contribute inside the same tools used by the rest of the team. That means fewer disruptions and smoother delivery, no matter the season.

Conclusion

Finance and legal teams run on structure. When roles go unfilled, the risk is missed opportunities, delayed decisions, and overworked managers.

Nearshore staffing offers a faster, more flexible way to build coverage.

You get access to experienced professionals in nearby countries who already work in your tools, speak your language, and understand what’s expected.

But picking the right partner matters. Some agencies specialize in tech roles, others in admin. If you need finance and legal talent, you need a firm that understands those functions deeply, and knows how to fill them quickly.

Smooth daily coordination matters, learn how to run effective standups across time zones with nearshore teams to keep workflows moving.

LatamCent helps SaaS companies hire finance and legal talent in under 21 days, backed by a 100-day guarantee. If you’re hiring, we’ll show you who’s available now and walk you through exactly how it works.