Are you considering expanding your team internationally in Latin America? An Employer of Record (EOR) can help you hire and manage talent without setting up a local legal entity.

In 2025, hiring internationally is easier than ever. You can partner with a nearshore staffing agency like LatamCent, establish your own legal entity in the country of your choice, or use an Employer of Record (EOR) platform that offers end-to-end EOR services.

There are pros and cons to EORs, but this guide is written to share with you the top EOR platforms in Latin America, so if you decide to go the Employer of Record route, you can make an educated choice.

We’ve compiled a ranked list of the Best EOR providers specializing in the Latam region.

We’ve evaluated them on Price (value, cost effectiveness), Customer Service (support quality and responsiveness), and Technology (platform strength, uptime, and usability). Each entry includes an overview, countries covered in LatAm, pricing, customer service reputation, tech platform strengths/weaknesses, key differentiators.

You can head to the bottom for a comparison table that summarizes pricing, customer service, and technical features for quick reference.

But before we dive into EORs for those unfamiliar, you can read a little about EORs vs Contractors below.

Read on!

What is an Employer of Record (EOR)?

An Employer of Record (EOR) is a third-party organization that takes on the legal responsibilities of employing workers on behalf of another company. The EOR acts as the legal employer, managing payroll, benefits administration, and compliance with local employment laws.

By using an EOR, businesses can easily navigate the complexities of local labor laws and regulations. The EOR ensures that all employment practices comply with local laws, thereby reducing the risk of non-compliance and associated penalties.

In the USA, it’s relatively easy to set up an LLC and business; you can pay an attorney or accountant, and for less than a thousand dollars, you have an entity, but in many countries, there are too many bureaucracies to jump through.

One of our clients invested over $5,000 and spent months consulting with lawyers in Colombia to set up an entity.

Benefits of Using an EOR

Using an Employer of Record (EOR) offers numerous advantages for companies looking to expand their global workforce.

Here are some of the key benefits:

-

Reduced administrative burden: EORs handle all HR and payroll tasks, including benefits administration, tax withholdings, and compliance with local employment laws and regulations.

-

Increased compliance: EORs ensure that all employment practices comply with labor laws and regulations, significantly reducing the risk of non-compliance and associated penalties.

-

Improved talent acquisition: By partnering with an EOR, companies gain access to a global talent pool. This lets them recruit the most suitable candidates for their business needs, regardless of geographic location.

-

More scalability: EORs enable companies to scale their global teams quickly, facilitating seamless international expansion. Whether you need to hire one employee or a hundred, an EOR can facilitate this without the need to establish a local entity in each country.

-

Cost savings: Using an EOR can be a cost-effective solution for global expansion. It reduces the need for expensive legal and HR expertise, as the EOR handles all compliance and administrative tasks.

This ensures that employees receive competitive benefits, which can be crucial for attracting and retaining top talent in different regions.

An EOR provides a comprehensive solution for managing international employees, ensuring compliance with local laws, and allowing companies to expand their global footprint efficiently and cost effectively.

Responsibilities of an EOR

An EOR handles various tasks to ensure that employees are hired and managed following local employment laws and regulations. These responsibilities include compliance, payroll, taxes, and benefits administration, providing a comprehensive solution for managing international employees.

Onboarding Employees

EORs facilitate the local onboarding process for international employees, managing all administrative tasks, including employment contracts, background checks, and payroll setup.

This ensures a smooth onboarding process, creating a positive first impression of the company. By handling these tasks, EORs enable businesses to integrate new hires quickly and efficiently, while adhering to local labor laws and regulations.

Paying Employees in Local Currencies

EORs simplify the process of paying team members in their local currency, reducing exchange rate risks and administrative hassles. They facilitate the payroll process, ensuring employees are paid on time and in their preferred currency.

Though depending on the country this isn’t a selling point.

For instance, Eze Campodonico from LatamCent a nearshore staffing agency always says, if you offered me my salary in Argentinian Peso I would never have accepted. The graph below tells you why.

The Argentinian Peso lost most of it’s value due to hyperinflation and made Argentina a really attractive place to find top talent and pay them in USD. Now there is also the option of USDC, stable coins. Nobody wants to keep their money in the Argentine Peso, and the Milei/Trump bond could lead to Argentina dollarizing.

Administering Employee Benefits Packages

EORs manage employee benefits packages that comply with local regulations and meet employee expectations.

They provide a comprehensive understanding of local statutory benefits and handle benefits administration, including healthcare plans, retirement plans, and other perks. This ensures that employees receive competitive benefits, which can be crucial for attracting and retaining top talent in different regions.

Withholding Taxes

EORs handle tax withholding for international employees, ensuring compliance with tax laws in each country.

They remit the necessary amount from an employee’s paycheck to the appropriate authorities, providing a cost effective solution to tax withholding. This reduces the risk of non-compliance and associated penalties, allowing businesses to operate smoothly across multiple jurisdictions.

Though because of currency devaluation, many workers will prefer to pay their own taxes and get paid in dollar. Argentina isn’t the only one with currency struggles.

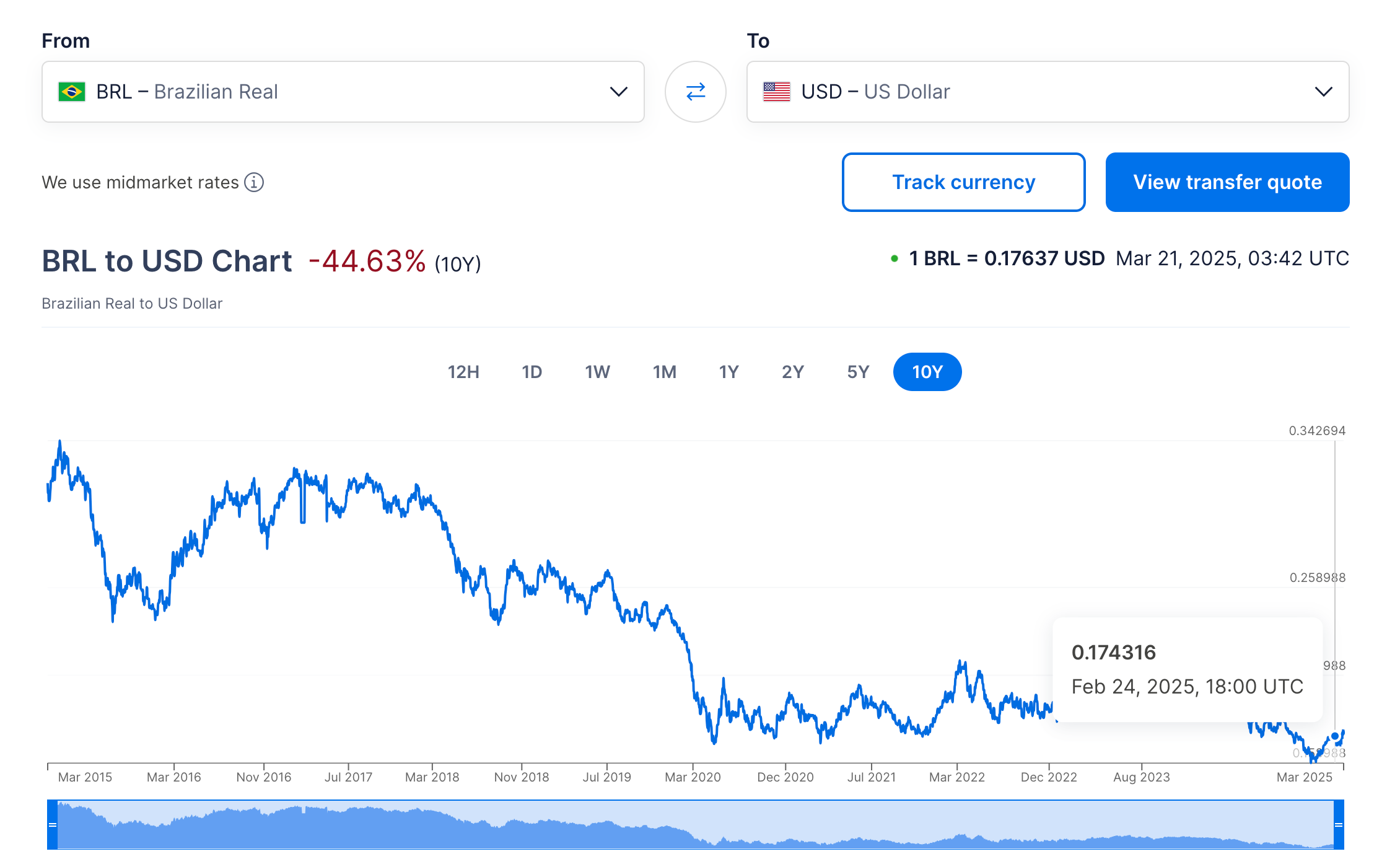

Brazil’s leftist government has been struggling to maintain their currency valuation compared to the dollar.

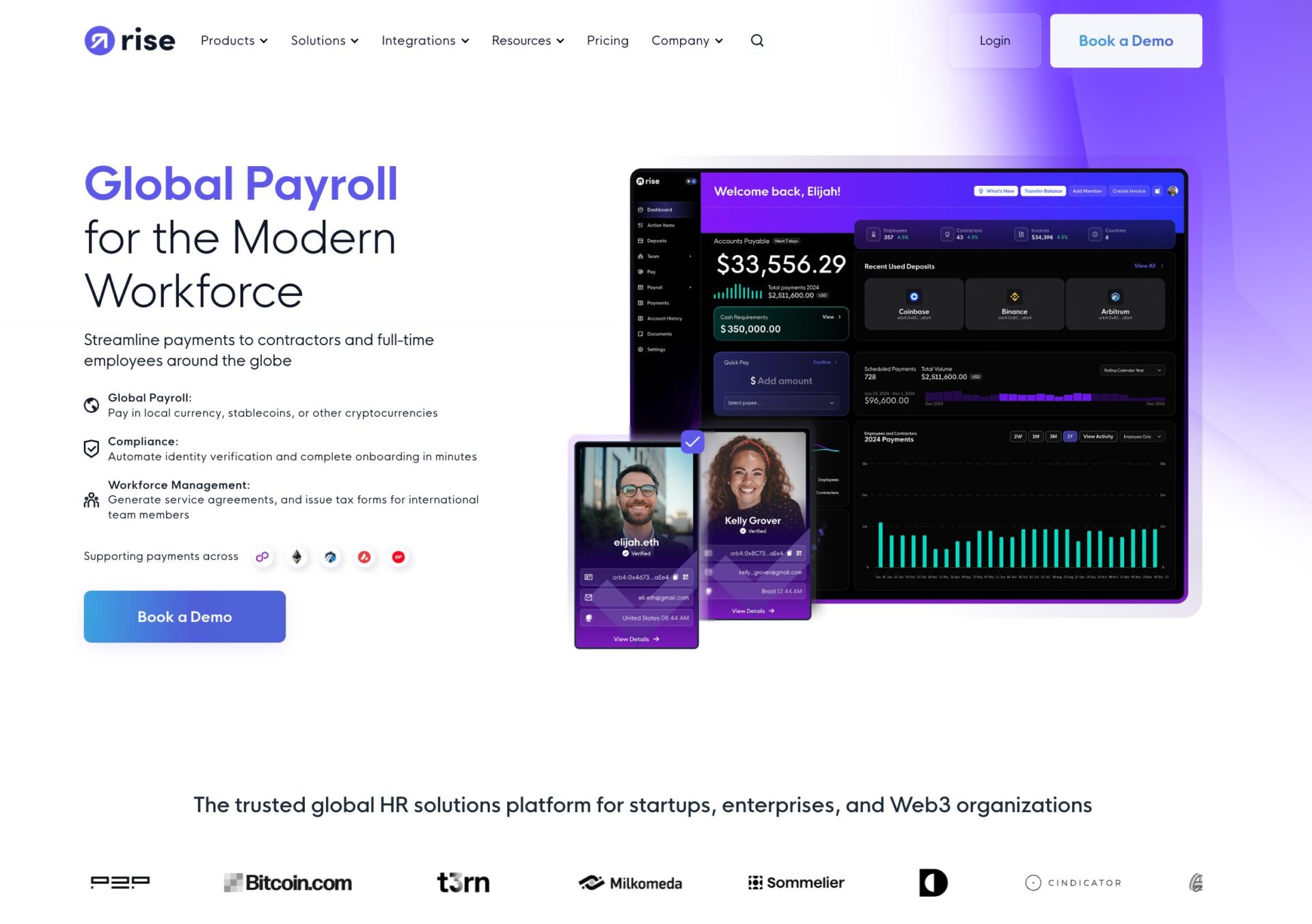

1. RiseWorks: Best for Crypto-Paid Teams Hiring in LATAM (USDC Payroll, Legal Wrappers, Web3-Friendly)

RiseWorks is a compliant staffing agency and Employer of Record (EOR) platform tailored for Web3-native startups, DAOs, and remote-first companies. It enables international employment across Latin America by managing local compliance obligations, without requiring you to set up your own entity in each country.

But what sets RiseWorks apart is its crypto-native infrastructure. The platform enables payments in stablecoins, particularly USDC, making it the go-to hiring partner for blockchain-native teams.

Founded in 2019 by fintech and legal professionals Hugo Finkelstein and Andrew Maurer, RiseWorks bridges traditional staffing models with cutting-edge Web3 operations.

It manages the full hiring process drafting compliant contracts, overseeing benefits, and handling health insurance while meeting all compliance issues in each country it serves.

Countries Covered by RiseWorks:

-

Mexico

-

Colombia

-

Argentina

-

Brazil

-

Peru

Key Differentiators:

-

Purpose-built for crypto-native payroll and international employment in emerging markets.

-

Legal-first approach ensures all tax, labor, and compliance obligations are addressed.

-

Supports compliant equity/token vesting, reducing legal risk for both the employer and worker.

-

Flexible payroll options in fiat or stablecoins, adapted to each team member’s country and preference.

Pricing

RiseWorks offers transparent, competitive pricing between $299–$399 per employee/month, depending on the country and compliance needs.

Contractor services start at $200/month, ideal for companies hiring team members overseas without full employer responsibilities. Custom packages are available for teams that pay entirely in crypto.

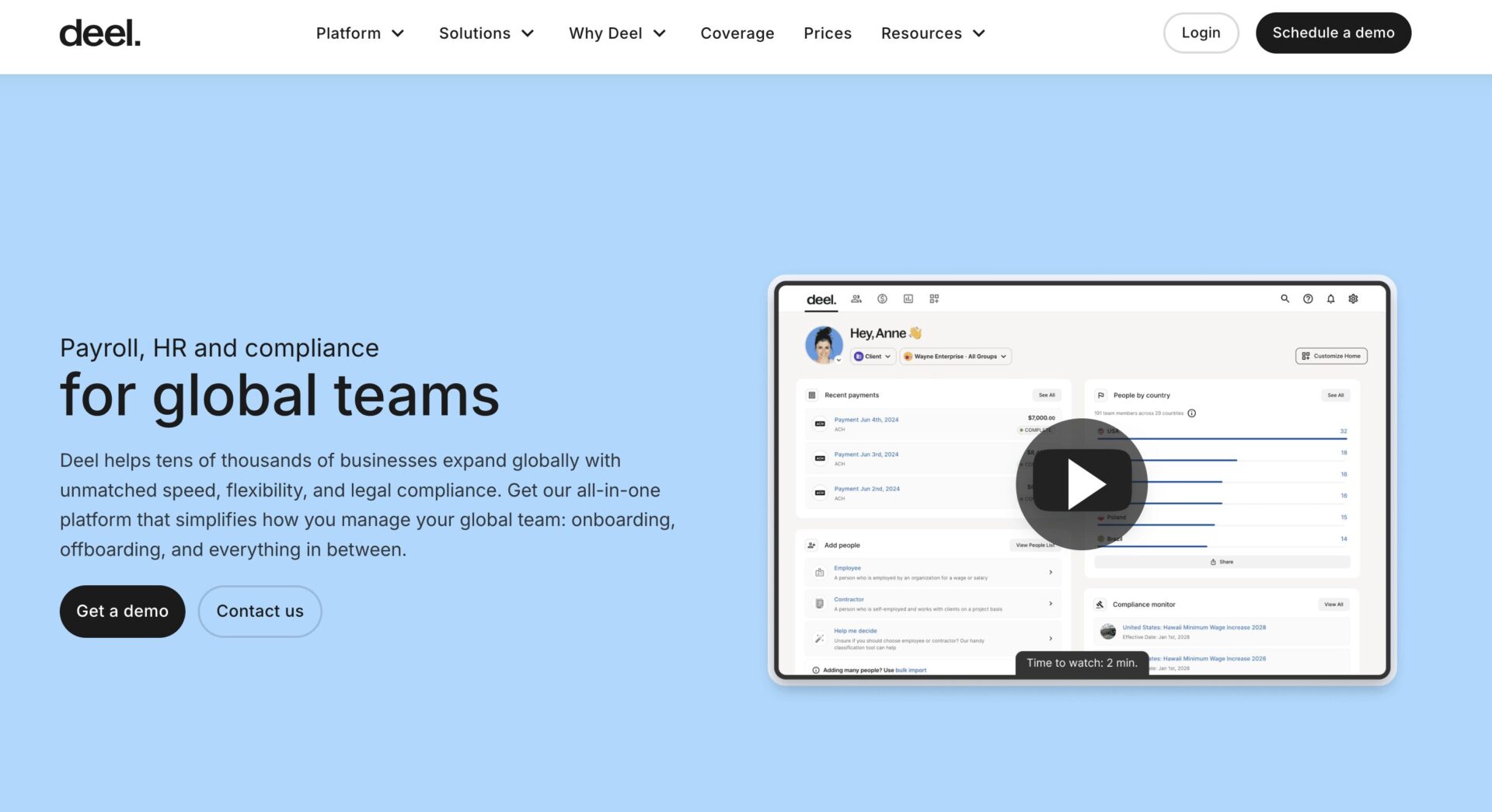

2. Deel: Best Overall for Latin America (Affordable, 24/7 Support, All inOne Platform)

Deel is a global platform that provides comprehensive Employer of Record (EOR) and staffing agency services, helping companies employ workers in over 150 countries including every country in Latin America without creating a foreign entity.

Deel simplifies international employment by handling the full hiring process: payroll management, benefits administration, contract generation, and local compliance.

Founded in 2019 by Alex Bouaziz and Shuo Wang, Deel has become a leader in global employment solutions.

It helps businesses avoid compliance issues while offering a consistent experience across LATAM, whether you’re onboarding one new team member or hundreds.

Countries Covered by Deel:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

-

Uruguay

-

Costa Rica

-

Panama

-

Ecuador

Note: Deel does not operate in U.S.-sanctioned countries such as Venezuela and Cuba.

Key Differentiators:

-

End-to-end platform covering onboarding, payroll, HR tools, and equipment logistics in 130+ countries.

-

Global coverage for international employment across Latin America and beyond.

-

Flat-fee pricing structure with no hidden costs—ideal for predictable budgeting.

-

Consistently rated higher than competitors in 80%+ of G2 categories (Fall 2024).

Pricing

Deel offers flat-rate pricing starting at $599 per employee/month, with variations depending on location and headcount. Pricing includes all services: payroll, local compliance, benefits, and HR support.

Contractor management is also available at competitive rates. For larger teams, custom quotes and volume discounts help improve cost savings.

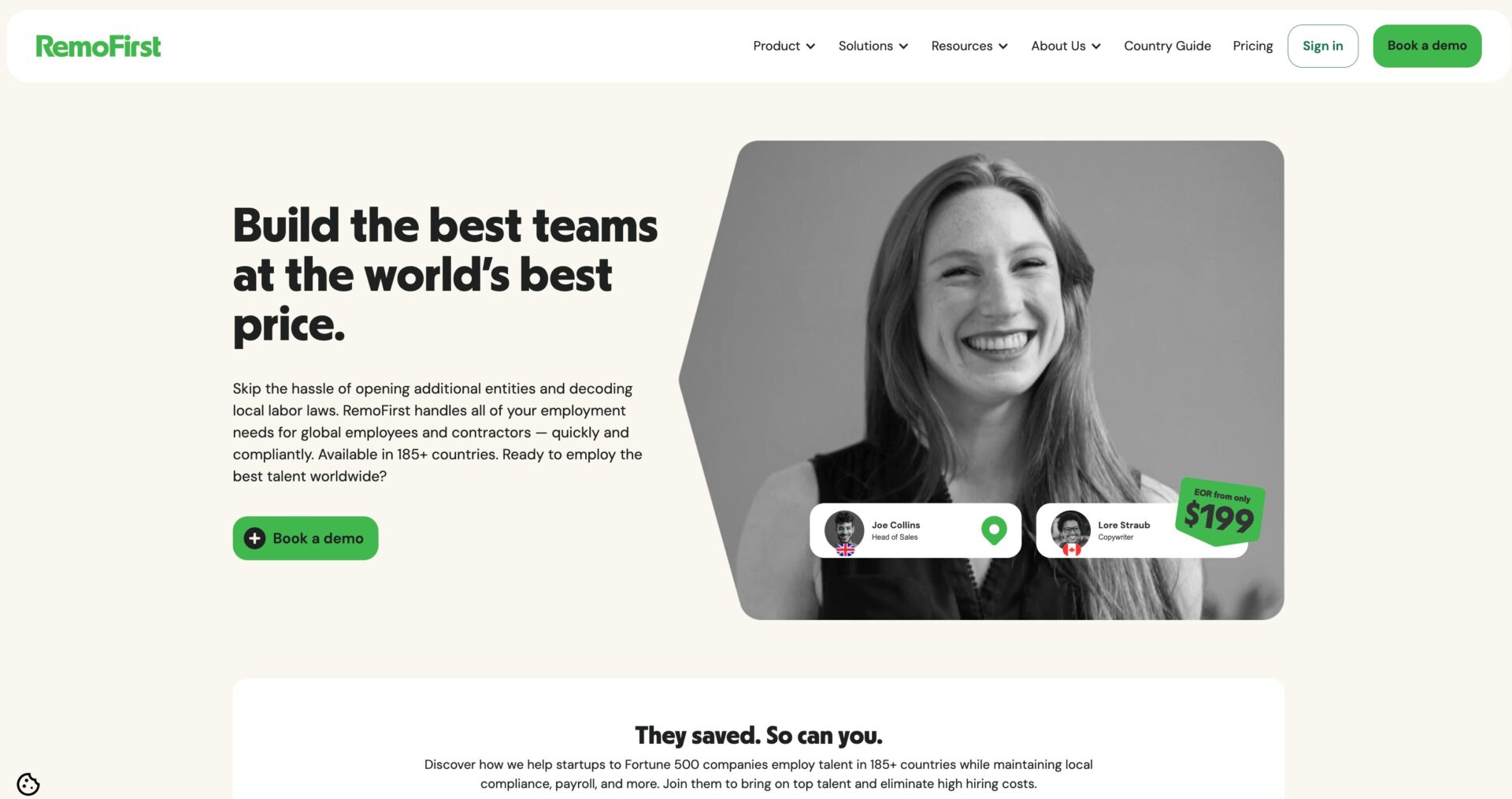

3. Remofirst: Best for Budget Conscious Expansion (Lowest Fees, Dedicated Account Manager)

RemoFirst is a global Employer of Record (EOR) platform and staffing agency that enables businesses to hire employees overseas including full-time team members and contractors in over 180 countries, with full coverage across Latin America.

It eliminates the need to establish a local legal entity, helping companies expand into foreign countries while reducing legal exposure, compliance issues, and permanent establishment risk.

Founded in 2021 by Nurasyl Serik and Volod Fedoriv, RemoFirst was built by experienced remote-work entrepreneurs.

CEO Nurasyl, a Forbes 30 Under 30 honoree, brings a deep understanding of global startups, while COO Volodymyr leads efforts to streamline global operations and simplify employment of global employees in emerging markets.

Countries covered by RemoFirst:

-

Brazil

-

Mexico

-

Chile

-

Argentina

-

Guatemala

-

Ecuador

-

Colombia

-

Peru

-

Uruguay

-

Paraguay

Key differentiators:

-

Offers the same services as top EOR providers at a fraction of the cost, making it the most affordable option in the industry.

-

Ensures reliable legal compliance by managing regulatory requirements and tax obligations through local experts in every country.

-

Combines global reach with a strong local presence, operating in over 180 countries as both a staffing agency and EOR provider.

-

Provides dedicated account management, with a 3:1 customer success-to-sales ratio that supports both the employer and the team member.

Pricing

RemoFirst delivers unmatched cost savings with flat pricing at $199 per employee/month, making it the most affordable EOR provider in the market.

There are no setup fees, hidden costs, or confusing add-ons. One invoice covers everything from employment contracts and benefits administration to payroll and health insurance.

4. Papaya Global: Best for Enterprises (Advanced Tech, AI Powered Payroll, Extensive Coverage, Compliance Risks)

Papaya Global is an enterprise-grade Employer of Record (EOR) and professional employment organization designed for companies managing global operations across multiple countries.

As both a global payroll solution and third-party service provider, Papaya helps businesses employ workers internationally without setting up their own entity in each region.

Unlike a traditional staffing agency, Papaya Global takes full responsibility for the hiring process, handling everything from payroll management and health insurance to data security, benefits, and compliance obligations.

Founded in 2016 by Eynat Guez, Ruben Drong, and Ofer Herman, Papaya Global serves large companies hiring global employees in Latin America and beyond.

Its platform uses AI-powered automation to eliminate manual HR tasks and reduce compliance issues, helping you focus on scaling rather than risk mitigation.

Countries covered by Papaya Global:

-

Argentina

-

Brazil

-

Chile

-

Colombia

-

Ecuador

-

Mexico

-

Panama

-

Peru

-

Uruguay

-

Venezuela

Key Differentiators:

-

Enterprise-grade automation for the hiring process, including onboarding, payroll, and benefits in the same country or across borders.

-

Supports international employment through local entities while acting as a compliant third-party service provider.

-

Business intelligence dashboards help optimize cost savings and compare hiring in multiple countries.

-

Proven data security and zero compliance failures across thousands of global employees.

Pricing

Papaya Global offers custom pricing tailored to large-scale employers and global teams. While its EOR pricing may be higher than startups-focused solutions, it becomes cost-effective at scale especially for companies employing workers in multiple regions.

All services employment contracts, health insurance, benefits administration, and payroll are bundled in a single invoice. Free demos and ROI analyses are available.

5. Remote: Best Full Service EOR with Comprehensive Benefits, IP Protection, and Local Employment Laws

Remote is a full-service Employer of Record (EOR) platform and professional employment organization that enables companies to manage international employment in over 170 countries without the need to establish a local legal entity.

It’s designed for businesses that want to hire global employees while maintaining full compliance with local regulatory requirements.

Founded in 2019 by Job van der Voort and Marcelo Lebre, Remote helps companies expand without borders by offering consistent EOR services that simplify global operations especially in Latin America.

The platform supports the onboarding of new team members, contractor management, and ensures your intellectual property remains secure, even when you don’t operate in the same country.

Countries covered by Remote:

-

Argentina

-

Brazil

-

Chile

-

Colombia

-

Costa Rica

-

Ecuador

-

Mexico

-

Panama

-

Paraguay

-

Peru

-

Uruguay

Key Differentiators:

-

All-in-one solution that allows you to employ workers without your own entity in each country.

-

Strong IP protection ensures your company retains all rights while hiring across multiple countries.

-

Competitive local benefits packages that help attract and retain top talent in Latin America.

-

Offers the same services as other global providers but with greater transparency and better customer support.

Pricing

Remote offers flat, transparent pricing at $599 per employee/month. This includes full EOR services: payroll, compliance obligations, health insurance, benefits administration, and HR support.

Contractor management is free until payment, making it ideal for teams blending freelancers and full-time staff. No setup fees, hidden costs, or long-term commitments just scalable support for growing teams worldwide.

6. Oyster HR Best for User Friendly Platform, Benefits Administration, and Global Benefits on a Budget

Oyster is a remote-first Employer of Record (EOR) platform and professional employment organization designed to help companies employ workers across 180+ countries, including every country in Latin America.

The platform enables international employment without the need for companies to establish their own entity in each location eliminating legal exposure, reducing compliance issues, and simplifying the hiring process.

Founded in 2020 by Tony Jamous and Jack Mardack, Oyster prioritizes the team member experience by offering a streamlined onboarding process, regionally compliant health insurance, and competitive benefits making it ideal for startups and mid-sized businesses scaling their global operations.

Countries covered by Oyster:

-

Argentina

-

Brazil

-

Chile

-

Colombia

-

Costa Rica

-

Ecuador

-

Mexico

-

Panama

-

Paraguay

-

Peru

-

Uruguay

(Full coverage of all Latin American countries via entities and partners)

Key differentiators:

-

The platform is easy to use and designed to simplify international hiring for companies new to global employment.

-

Manages localized benefits administration, including health, dental, and wellness coverage tailored to local standards.

-

Ensures full compliance across payroll, labor laws, and tax regulations, minimizing legal risks and safeguarding employee data.

-

Promotes socially responsible hiring by supporting global employment access, diversity, and the inclusion of refugees.

Pricing

Oyster HR offers flat-rate pricing at $599 per employee/month with an annual plan ($699/month if billed monthly). There are no setup fees, hidden costs, or minimums.

Pricing includes full EOR services: onboarding, payroll, benefits, and compliance obligations.

Clients also get access to tools like country hiring guides, legal templates, and a global HR dashboard.

7. Globalization Partners: Pioneer of Employer of Record

Globalization Partners (GP) is a pioneer in the Employer of Record (EOR) industry, offering enterprise-level support and owned legal entities in over 180 countries.

Its proprietary platform, GP Meridian, automates payroll management, onboarding, benefits administration, and compliance tracking empowering companies to hire team members in foreign countries without setting up their own legal entity.

Founded in 2012 by Nicole Sahin, GP provides full responsibility for employer tasks in both emerging markets and mature economies.

The company helps clients avoid compliance issues and legal exposure by maintaining legal presence and deep regulatory expertise in each region especially in Latin America, where it operates a regional hub in Mexico City.

Countries Covered by GP:

-

Brazil

-

Mexico

-

Colombia

-

Chile

-

Argentina

-

Peru

(Supports 180+ countries, excluding sanctioned regions such as Cuba)

Key Differentiators:

-

Owned legal entities in 95% of countries, eliminating reliance on third-party service providers.

-

Robust compliance infrastructure to handle full employer responsibilities across regions.

-

GP Meridian platform automates the hiring process, payroll, and HR tasks.

-

Minimizes permanent establishment risk and aligns with local employment laws.

-

Trusted by global enterprises, including Fortune 500 companies, for secure international employment.

Pricing

Globalization Partners offers transparent EOR pricing ranging from $500–$800 per employee/month, with a typical flat rate around $599.

Pricing varies based on country, employee count, and additional services like off-cycle payroll or currency conversions.

Enterprise clients often benefit from custom quotes and discounts. All services employment contracts, benefits, data security, and compliance obligations are included in the monthly rate.

8. Omnipresent: International Employment

Omnipresent is a global Employer of Record (EOR) platform and professional employment organization that enables companies to hire international employees in over 160 countries.

Designed to simplify global employment, Omnipresent acts as a third-party service provider handling the hiring process, payroll management, compliance obligations, and benefits administration in a single secure platform.

With strong record services and support for foreign entities, Omnipresent reduces legal duties, mitigates compliance risks, and handles ongoing employment responsibilities allowing your client company to scale globally without establishing local entities.

Founded in 2019 by Guenther Eisinger, Omnipresent serves businesses seeking cost savings, operational simplicity, and legal compliance while scaling across global operations.

Countries Covered by Omnipresent:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

-

Uruguay

-

Costa Rica

-

Ecuador

-

Panama

Key Differentiators:

-

Extensive international employment coverage in 160+ countries, including every LATAM nation

-

Strong compliance infrastructure covering tax, labor, and health insurance requirements

-

Centralized platform to manage payroll, benefits, and legal duties across multiple countries

-

Ideal for companies without a local legal entity seeking efficient and compliant hiring

-

Minimizes legal exposure and administrative burden when hiring team members abroad

Pricing

Omnipresent offers transparent flat-rate pricing starting at $499 per employee/month. Rates are tailored to each foreign country and team size. Pricing includes full EOR services: employment contracts, health insurance, payroll, benefits, and compliance support—with no setup fees or hidden charges.

9. Velocity Global: Global Work Platform

Velocity Global is a top-tier Employer of Record (EOR) platform and global work solution that helps companies employ workers and manage compliance obligations across 185+ countries, including full coverage throughout Latin America.

Velocity Global eliminates the need to establish a local legal entity by acting as a staffing agency and third-party service provider handling full employer responsibilities for team members worldwide.

Founded in 2023 by Ben Wright, Velocity Global enables global operations through its proprietary EOR infrastructure and AI-powered platform.

The platform streamlines the hiring process, benefits administration, and payroll management ensuring companies remain compliant with local regulatory requirements and minimize permanent establishment risk.

Countries Covered by Velocity Global:

-

Argentina

-

Brazil

-

Chile

-

Colombia

-

Costa Rica

-

Ecuador

-

Mexico

-

Panama

-

Paraguay

-

Peru

-

Uruguay

Key Differentiators:

-

Unmatched global coverage across 185+ countries, with legal and HR support in every region

-

Full responsibility for payroll management, benefits, compliance, and employer duties

-

AI-powered platform that simplifies onboarding and employment tasks across multiple countries

-

Supports companies without a local legal entity and helps avoid legal exposure or compliance issues

-

Personalized support team with expertise in global employment laws and local regulations

Pricing

Velocity Global offers flat-rate EOR pricing starting at $599 per employee/month. Final pricing depends on country, number of team members, and employment scope. All core EOR services employment contracts, payroll, health insurance, benefits, and regulatory compliance are included.

Custom quotes are available for businesses hiring in foreign countries or operating across multiple regions.

10. Multiplier: End to End EOR Solution

Multiplier is a global Employer of Record (EOR) platform and professional employment organization that helps businesses hire international employees and manage ongoing employment responsibilities in over 150 countries.

Its platform consolidates key functions like payroll management, benefits, and compliance obligations helping companies scale across borders without setting up a local legal entity.

Founded in 2020 by Sagar Khatri and Amritpal Singh, Multiplier enables international employment while meeting complex regulatory requirements, offering end-to-end EOR services that support global operations with simplicity and full compliance.

Countries Covered by Multiplier:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

-

Uruguay

-

Costa Rica

-

Ecuador

-

Panama

Key Differentiators:

-

Manages compliance obligations and legal exposure in over 150 countries

-

Offers complete employment law alignment without requiring your own entity

-

Reduces permanent establishment risk with full responsibility for HR, tax, and contracts

-

Offers comprehensive global payroll, statutory benefits, and optional health insurance

Pricing

Multiplier offers flat-rate pricing starting at $400 per employee/month. This includes full Employer of Record services payroll management, contracts, compliance, and benefits administration.

Contractor support and additional services may be priced separately.

Multiplier is ideal for companies looking for cost savings without compromising on service quality.

11. Skuad: HR and Automation Powered EOR

Skuad is an automation-powered Employer of Record (EOR) and staffing agency alternative that enables businesses to hire international employees in over 160 countries.

Designed for startups and agile teams, Skuad automates critical HR tasks employment contracts, payroll, benefits, and legal compliance allowing companies to expand without establishing a local legal entity.

Founded in 2019 by Nishant Taneja, Skuad is trusted by fast-scaling companies that need to hire across multiple countries and minimize legal risk.

The platform helps employers manage a distributed team while meeting all regulatory and compliance obligations with speed and precision.

Countries Covered by Skuad:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

-

Costa Rica

-

Panama

-

Uruguay

-

Ecuador

Key Differentiators:

-

Full legal responsibility for hiring and employing workers overseas

-

Mitigates compliance issues and legal exposure through built-in frameworks

-

Handles tax, labor, and benefits law alignment per country

-

Offers payroll management and local benefits support in each region

Pricing

Skuad starts at $199 per employee/month and $19/month for contractors. All core Employer of Record services are included contracts, payroll, benefits administration, and compliance.

Some benefits, such as health insurance, may be priced separately depending on the country. With no setup fees and an automation-first approach, Skuad offers one of the most budget-friendly ways to manage global employees.

12. Safeguard Global: Compliance Focused EOR

Safeguard Global is a seasoned Employer of Record (EOR) provider that enables global hiring while minimizing risk. Known for its strict focus on compliance obligations and tax regulations, it helps client companies operate internationally without needing to establish their own local legal entity.

With 15+ years of experience, Safeguard Global supports enterprise-level HR tasks, workforce administration, and global payroll operations in over 170 countries, including full coverage across Latin America.

Founded in 2008 by Bjorn Reynolds, it serves multinational corporations and high-growth companies by acting as the legal employer, helping them manage employee data, local tax, contracts, and benefit compliance across multiple jurisdictions.

Countries Covered by Safeguard Global:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

-

Costa Rica

-

Ecuador

-

Panama

-

Uruguay

Key Differentiators:

-

Deep expertise in tax regulations, labor law, and cross-border legal structures

-

Ensures transparency and accuracy in wage, bonus, and allowance reporting

-

Covers full-time team members and contractors across multiple countries

-

Flat-rate EOR pricing avoids hidden fees and enables budgeting accuracy

Pricing

Safeguard Global offers custom pricing, typically ranging from $499–$600 per employee/month, depending on the country and level of service.

Contractor pricing starts from $5–$10 per contractor/month. Each plan includes full EOR services: employment contracts, payroll management, benefits administration, and compliance with local tax and labor regulations all under a single invoice per region.

13. Atlas HXM

Atlas HXM is a comprehensive Employer of Record (EOR) and third-party service provider that simplifies global hiring for companies expanding into multiple countries, including across Latin America.

With its own entity infrastructure in over 160 countries, Atlas enables rapid market entry while maintaining full compliance with tax regulations and employment laws all through one centralized platform.

Founded in 2015 by Jim McCoy, Atlas delivers seamless EOR services, including HR tasks, payroll, health insurance, and employee data security making it ideal for both fast-growing companies and large enterprises.

Countries Covered by Atlas:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

-

Uruguay

-

Costa Rica

-

Panama

-

Ecuador

Key Differentiators:

-

Helps the client company stay compliant while avoiding foreign entity setup

-

Connects payroll with employee data for transparent compensation tracking

-

Ideal for companies needing structured HR tasks across borders

-

Ensures secure data management aligned with enterprise-grade protocols

Pricing:

Atlas HXM pricing begins at $595 per employee/month for full EOR services. This flat rate includes payroll, benefits administration, compliance, and data security with no setup fees or local entity requirements.

Optional services such as visa sponsorship, global mobility, and enhanced analytics may incur additional fees.

14. Mercans: AI Powered Payroll Employer of Record

Mercans is a high-performance Employer of Record (EOR) and payroll management platform operating in over 160 countries.

Built on its proprietary SaaS solutions G2N Nova and HR Blizz™ Mercans empowers businesses to manage global hiring, payroll, and compliance obligations without relying on a third party service provider.

Founded in 2003 by Tatjana Domovits, Mercans is trusted by global enterprises for secure, accurate payroll and end-to-end HR tasks.

The platform eliminates the need for establishing legal entities abroad by serving as the legal employer, ensuring adherence to tax regulations and local labor laws across all operations.

Countries Covered by Mercans:

-

Mexico

-

Brazil

-

Colombia

-

Chile

-

Argentina

-

Peru

-

United States

-

United Kingdom

-

Germany

-

United Arab Emirates

-

India

-

Singapore

-

South Africa

Key Differentiators:

-

AI-powered platform (HR Blizz™) ensures accuracy in employee data and payroll

-

Full compliance with local tax, labor, and benefits regulations

-

Provides competitive benefits packages aligned with local standards

-

Enables client companies to enter new markets quickly

Pricing

Mercans offers flat-rate EOR pricing between $299–$599 per team member/month, depending on country and required services.

This includes payroll management, benefits, data security, and compliance support without the need to establish a local legal entity.

15. Plane: Best for Startups & SMBs Expanding Globally

Plane is a startup-friendly Employer of Record (EOR) and global payroll platform built to help small and mid-sized companies hire employees and contractors in 100+ countries.

Focused on cost efficiency, Plane manages payroll, HR tasks, and compliance, eliminating the need to create a local legal entity in each market.

Founded in 2015 by Matt Pelc, Plane is especially well-suited for lean teams scaling across borders. Its full-service EOR offering handles payroll, local tax, benefits, and even equity allowing companies to onboard international team members without incurring excessive administrative burden.

Countries Covered by Plane:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

Key Differentiators:

-

Focused on agile global hiring strategies for smaller firms

-

International transfers included offering cost savings over competitors

-

Assumes full compliance responsibility for tax regulations and labor laws

-

Designed for low-overhead market entry with full legal coverage

Pricing

Plane offers flat-rate EOR pricing around $499 per employee/month, with no setup fees or hidden costs. This includes complete payroll processing, compliance, benefits, and equity handling ideal for companies hiring abroad without establishing legal entities.

16. GoGlobal: Latin America-Focused Hiring

GoGlobal is a flexible Employer of Record (EOR) provider offering full-service global hiring in 145+ countries, including all of Latin America.

Built around its secure BlueOcean platform, GoGlobal simplifies hiring, payroll management, and compliance obligations without requiring companies to establish a local legal entity.

Founded in 2018 by Andrew Lindquist, GoGlobal serves as a dedicated third party service provider, allowing your client company to enter new markets quickly.

The platform handles all critical HR tasks, from payroll and benefits to contracts and employee data, minimizing legal exposure and reducing the administrative burden across multiple countries.

Countries Covered by GoGlobal:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

-

Costa Rica

-

Panama

-

South Africa

-

UAE

-

United Kingdom

-

Germany

-

India

-

Singapore

-

United States

Key Differentiators:

-

BlueOcean platform automates contracts, payroll, and compliance issues across borders

-

Enables fast market entry, often within two weeks

-

Supports global operations with real-time visibility and reporting

-

Covers full responsibility for legal employment, minimizing legal entities setup requirements

Pricing

GoGlobal provides custom pricing, typically between $300–$499 per employee/month, depending on country and services selected. Packages include:

-

Flat monthly EOR fee (payroll, benefits, compliance, and HR tasks)

-

Optional add-ons like contractor management and system integrations

-

Transparent billing and volume-based discounts

17. Agile HRO: Best for Budget-Friendly Hiring in Asia & LatAm

Agile HRO is a value-driven Employer of Record (EOR) and global payroll provider focused on emerging markets in Latin America and Asia.

Designed for cost-conscious companies, it enables fast and compliant global hiring without requiring a local legal entity.

Agile handles everything from payroll management and benefits administration to local tax regulations and legal compliance.

Founded in 2017 by Jamie Haerewa and Leon Farrant, Agile HRO serves as a full-service third party service provider.

It’s ideal for startups and SMBs entering multiple countries while keeping overhead low and compliance risk minimal.

Countries Covered by Agile:

-

Mexico

-

Brazil

-

Colombia

-

Chile

-

Peru

-

India

-

Philippines

-

Indonesia

-

Thailand

-

Vietnam

Key Differentiators:

-

One of the lowest-cost EOR services in Asia & Latin America

-

Tailored for small teams scaling without complex legal infrastructure

-

Prevents legal exposure and ensures smooth onboarding of new team members

-

Modular features for growing client companies

Pricing

Agile HRO uses a flat-rate subscription model: Starts around $399 per employee/month.

Covers full EOR service: payroll, compliance, HR tasks, and benefits. Optional add-ons vary by country (e.g., local benefits, contractor support)

This pricing offers significant cost savings for companies managing global employees without setting up a foreign entity.

18. Ontop: Latin America Focused EOR Provider Deep Dive

Ontop is a cost-effective Employer of Record (EOR) platform tailored to startups and SMBs expanding across Latin America.

It allows companies to hire full-time international team members without setting up a local legal entity, streamlining the hiring process, payroll, and compliance in one centralized platform.

Founded in 2020 by Jaime Abella and Julian Torres, Ontop combines intuitive technology with concierge-level service to help companies navigate local tax, labor regulations, and compliance obligations.

The platform automates key HR tasks, including issuing compliant contracts, managing employee data, and handling health insurance offering true end-to-end support for global hiring.

Countries covered by Ontop:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

Key Differentiators:

-

No forex markups or hidden fees transparent billing and free international transfers

-

Specialized in Latin America, with partnerships across legal entities and bilingual support teams

-

Latin America specialization with deep regional knowledge, local legal entity partnerships, and customer-first, bilingual support

-

Automated payroll management, benefits, and contract generation tailored for fast-growing businesses

Pricing

Employer of Record (EOR): From $499/month per employee, including payroll, health insurance, and full regulatory requirements.

Contractors: From $49/month, including legal agreements and cross-border payments. No setup fees and all-inclusive billing ideal for reducing legal risks when hiring across multiple countries

19. Serviap Global International PEO/EOR

Serviap Global is a family-owned Employer of Record (EOR) provider rooted in Mexico and focused on delivering personalized HR solutions for international businesses.

With over 15 years of experience, Serviap provides full compliance support, HR tasks coverage, and payroll administration for businesses operating across Latin America and beyond.

Founded by Victor, David, and Julio Anaya, Serviap began as a local staffing agency acts in Mexico and expanded into a global EOR leader.

With over 15 years of experience, the Anaya family has built deep trust in Latin America and beyond, bringing a highly personalized customer experience to international employment and global operations.

Countries Covered by Serviap:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

Peru

-

Costa Rica

-

Panama

-

Ecuador

-

Uruguay

Key Differentiators:

-

Ideal for companies needing hiring + operational support

-

Automates payroll, benefits, and contract management

-

Strong local presence and cultural understanding, helping reduce legal exposure for companies entering the region

-

Helps businesses stay compliant while entering multiple countries

Pricing

Serviap Global offers flat-rate Employer of Record (EOR) pricing, typically starting around $349 per employee/month, with no setup fees or hidden charges.

This includes complete payroll management, compliance obligations, benefits administration, and local tax handling ideal for companies hiring in foreign countries without needing to establish a legal entity.

20. Rippling: IT Powered Global Employer of Record

Rippling is an all-in-one HR, IT, and payroll platform that added Employer of Record (EOR) capabilities in 2021, offering global hiring in 80+ countries without requiring your business to set up its own legal entity.

Built for fast-growing tech companies, Rippling simplifies the hiring process, global payroll, benefits administration, and compliance obligations from a unified platform.

Founded in 2016 by Parker Conrad and Prasanna Sankar, Rippling blends back-office automation with international employment ideal for companies expanding into multiple countries while managing sensitive employee data and IT access from one dashboard.

Countries Covered by Rippling:

-

Mexico

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

India

-

United Kingdom

-

Germany

-

Canada

-

Japan

Key Differentiators:

-

Combines HR tasks, payroll management, device provisioning, and compliance tracking in one interface

-

Built-in workflows ensure alignment with tax regulations, PTO rules, and labor laws

-

Ideal for companies managing both U.S. and international team members

-

Automates hiring workflows for team members in multiple countries

Pricing

Rippling offers modular, transparent pricing tailored to each company’s global hiring needs.

Core platform: Starts at $8 per team member/month, plus a $35 monthly base fee

Global payroll: Estimated at $20–$35 per international employee/month

Employer of Record (EOR) services: Typically $500–$599 per employee/monthly

21. Bitwage: Best for Hybrid Crypto Payroll (BTC, ETH, USDC Options + Tax Support)

Bitwage is a unique Employer of Record (EOR) and global payroll platform tailored for businesses paying team members in cryptocurrency and fiat.

Since 2014, it has supported international employment in LATAM by handling contractor payments, payroll taxes, and compliance without the need to set up a foreign entity.

Bitwage is ideal for startups and crypto-native firms seeking cost-effective, fast global payouts.

Founded in 2014 by Jonathan Chester and John Lindsay, Bitwage pioneered crypto-based payroll, now serving companies across Latin America and beyond with deep local presence and secure financial infrastructure.

Countries covered by Bitwage:

-

Argentina

-

Brazil

-

Chile

-

Colombia

-

Mexico

-

Peru

-

Panama

-

Venezuela

Key differentiators:

-

Supports payments in BTC, ETH, stablecoins (USDC/USDT), and local fiat

-

Offers built-in tax withholding and compliance obligations for each foreign country

-

Transparent pricing: 1% for fiat, 2–3% + flat fee for stablecoins

-

Aligns with regulatory requirements and anti-money laundering controls

Pricing

Bitwage offers flexible, pay-as-you-go pricing starting at $0, with no setup fees or contract minimums. EOR and payroll services typically range from 1% per transaction for local currency payouts to 2–3% plus a flat fee for stablecoin payments.

Premium plans start at $7.99–$15.99 per team member/month, covering multi-asset payroll management, faster processing, and dedicated support.

22. Juno: Best for U.S. Teams Paying LATAM Contractors in Crypto (Banking + Stablecoin Payout)

Juno is a U.S.-based neobank and crypto payroll solution designed for startups and remote-first businesses managing international employment in Latin America.

Though not a direct Employer of Record (EOR), Juno integrates with global EOR partners to ensure local compliance, offering fast, secure contractor payouts in stablecoins and fiat without requiring a local legal entity.

Founded by Varun Deshpande, Juno helps client companies manage the full hiring process, contractor payments, and global operations while navigating complex tax regulations and employment laws.

Its platform combines crypto banking, payroll management, and data security, creating a streamlined experience for companies paying remote team members in LATAM.

Countries covered by Juno:

-

Mexico

-

Brazil

-

Colombia

(Juno supports compliant payouts in stablecoins and fiat with local tax integration through its EOR partners.)

Key differentiators:

-

Seamless payouts in stablecoins like USDC or MXNB

-

Crypto debit card, yield on checking, and neobank features

-

Meets compliance obligations and tax regulations without forming a foreign entity

-

Combines payroll, banking, and HR tasks in one solution

Pricing

Juno offers transparent, no-commitment pricing:

-

Standard Plan (Free): 1% fee for fiat payouts; stablecoin payroll has no FX markup

-

Premium Plans: Enable same-day payouts and include EOR-integrated global hiring features

This model supports companies seeking cost savings while managing international payroll and employee data with high transparency.

Comparison Table: Pricing, Support, and Tech Features

| Provider | Pricing (per employee) | Customer Support | Tech Platform & Features | EOR Services |

|---|---|---|---|---|

| RiseWorks | $599/mo est. | Dedicated regional team & onboarding specialists | Strong LATAM focus; custom benefits packages; contractor & EOR support | EOR + contractor compliance, benefits & onboarding |

| Deel | $599/mo (flat). $49/contractor. Free up to 200 ppl | 24/7 live chat/email. Dedicated CSM. Excellent b2breviews.com | All-in-one platform; 90+ currencies; equipment & IP mgmt | Comprehensive EOR services; global hiring; compliance management |

| Remofirst | $199/mo (lowest). $25/contractor | 24/5 chat/email. Dedicated manager. High-touch | Modern platform; time-off & expenses; 1 invoice global | Flexible EOR services; cost-effective; local compliance |

| Papaya Global | From ~$15–$20 (enterprise quotes) | 24/7 multi-channel. Local teams. Enterprise-grade | AI-driven SaaS platform; integrates HRIS; real-time BI | Customizable EOR services; enterprise solutions; local expertise |

| Remote | $599/mo | Nearly 24/7 chat/email. CSM assigned. Great (improved) | Simple UI; global equity & benefits; IP protection slashdot.org | Scalable EOR services; global team management; compliance assurance |

| Oyster HR | $599/mo | Fast chat/email. HR experts. Very good | Easiest UX; automated contracts; global benefits add-ons | Efficient EOR services; automated processes; global reach |

| G-P (Globalization Partners) | $600–$800 | 24/7/365 “premium” support. Top-notch slashdot.org | AI-powered platform; extensive legal team; integrates HR peoplemanagingpeople.com | Premium EOR services; extensive legal support; global compliance |

| Omnipresent | From ~$100/mo base + usage. Custom EOR fees. | Dedicated CSM. Local experts. Proactive | Intuitive dashboard; fast onboarding (< 24h); compliance tools | Custom EOR services; fast onboarding; local expertise |

| Velocity Global | Custom (premium). Quote-based. | Dedicated team & local HR. Consultative | Global Work Platform; HRIS integration; mobility & visa support | Premium EOR services; mobility support; HRIS integration |

| Multiplier | $300/mo (EOR). $20/mo basic plan. | Chat/email support. Quick responses. Good | Fast self-serve platform; 150+ countries; 24h onboarding | Competitive EOR services; quick onboarding; global coverage |

| Skuad | $199/mo (EOR). $19/contractor. | Dedicated support, local experts. Strong | Integrated HR platform; 160+ countries; IP protection | Affordable EOR services; local expertise; IP protection |

| Safeguard Global | Custom (enterprise). | 24/7 access; local HR teams. Excellent | Own payroll tech; self-service portal; 170+ countries | Enterprise EOR services; local HR teams; extensive coverage |

| Atlas HXM | ~$595/mo peoplemanagingpeople.com (enterprise focus). | 24/5 support; direct entities. High-quality | Enterprise HXM platform; direct EOR in-country; analytics. | High-quality EOR services; direct in-country entities; analytics |

| Mercans | Custom (competitive global payroll rates). | Dedicated payroll experts. High-touch slashdot.org | Powerful global payroll system; multi-language; custom reports slashdot.org | Competitive EOR services; payroll expertise; multi-language support |

| Pilot | Custom low rates (startup friendly). | Friendly support (US-based). Good | Simple platform; focus on contractors & EOR in 100+ countries. | Startup-friendly EOR services; contractor focus; global reach |

| GoGlobal | Custom (APAC/EU focus pricing). | Regional support specialists. Good | Platform geared to APAC/EU (covers LatAm via network). | APAC/EU-focused EOR services; regional expertise; network coverage |

| Agile HRO | From $35/employee (Asia focus, covers LatAm). | Account manager model. Good | Global workforce platform; visa & relocation support. | Asia-focused EOR services; visa support; relocation assistance |

| Horizons | $290/mo (competitive flat). | Strong support + recruiting team. Great | Platform + integrated recruitment; 180+ countries; 24×5 support. | Integrated EOR services; recruitment support; global reach |

| Serviap Global | Custom (LatAm specialist, competitive). | Local LatAm teams. Excellent local insight | LatAm-focused PEO/EOR; personalized service; 10+ LatAm countries direct. | LatAm-focused EOR services; personalized approach; local expertise |

| Rippling | Custom quotes, built-in tech and HRIS software. | Worldwide, tech focused | LatAm + Worldwide EOR and tech | Has the best IT provisioning software and tech |

| Bitwage | Pay-as-you-go. 1–3% on payouts. Premium: $15.99/mo | Crypto-native client support | Bitcoin, ETH, USDC payroll; fiat + crypto options; same-day payments | Contractor payroll with crypto & fiat options |

| Juno | Free plan (1% fiat fee). Premium plans available | Crypto-first support; US-based team | Neobank + payroll combo; stablecoin MXNB; no forex markup | Crypto payments via EOR partners, LATAM contractors |

Legend: Bold indicates an exceptional rating or feature. Pricing is per employee per month unless noted. “Custom” indicates quote-based pricing.

All providers listed cover Latin America; differences lie in price, support, and platform capabilities.

By handling these tasks, EORs help businesses integrate new hires quickly and efficiently, adhering to local laws and regulations.

This approach helps mitigate compliance risks, ensuring that your international operations adhere to local regulations.

Are you looking for an EOR provider or nearshore staffing agency to help you start building your presence in Latin America? We’ll be happy to guide you through our process and make recommendations on which EOR or Contractor of Record will be best for you.